Redefining

Financial

Advisor-TPA

Collaboration

Introduction

The relationship between financial advisors (FAs) and TPAs has always been crucial to effective plan management. Yet, despite the shared objective of ensuring client satisfaction, the tools used to collaborate often fall short, resulting in inefficiencies that disrupt service delivery. Fragmented communication, a reliance on error-prone and slow-moving manual processes, and a lack of real-time data access have long hampered FAs’ ability to stay proactive and deliver timely advice to plan sponsors.

Our CX platform is designed to remove these barriers. By integrating client data, automating workflows, and centralizing communication, CX transforms the way FAs and TPAs collaborate, making it possible for FAs to access critical plan information in real time and contribute more effectively to the client experience.

The Disconnect: Challenges in TPA-FA Collaboration

Historically, FAs have faced significant obstacles when trying to stay informed about plan administration. Despite their advisory role, they are often left out of the operational loop, relying on delayed updates from TPAs that arrive via disconnected systems or long email chains. These inefficiencies slow down decision-making, leaving FAs less equipped to deliver the high-touch, strategic guidance that clients expect.

While FAs aren’t typically bogged down by the manual data entry tasks that TPAs handle, they are directly impacted by the delays and errors that result from manual processes. The lack of immediate access to plan updates, compliance reports, and census data creates a reactive rather than proactive dynamic, which can erode client trust over time.

CX’s Unified Platform: A New Approach to TPA-FA Collaboration

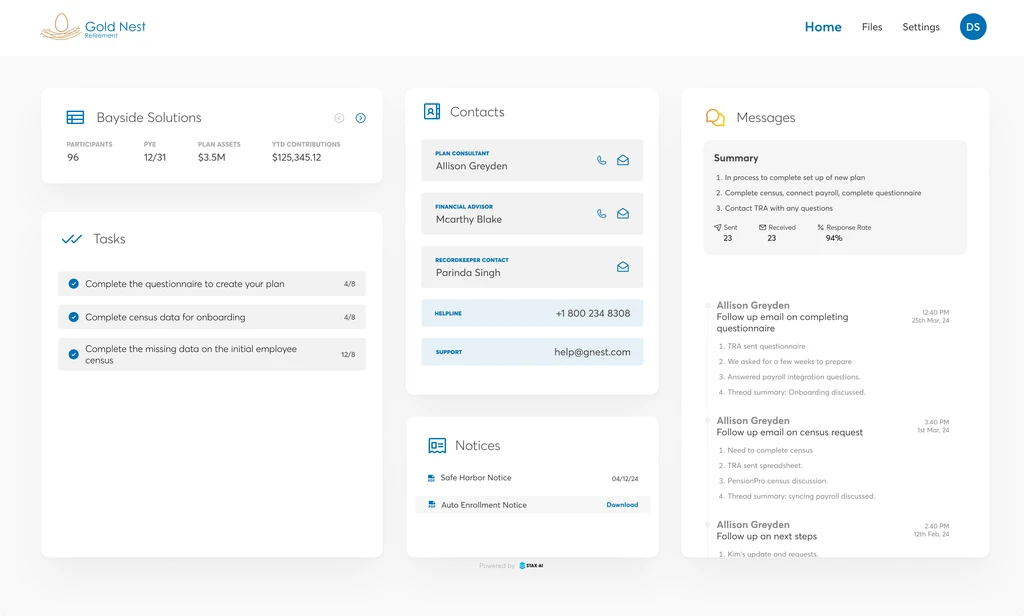

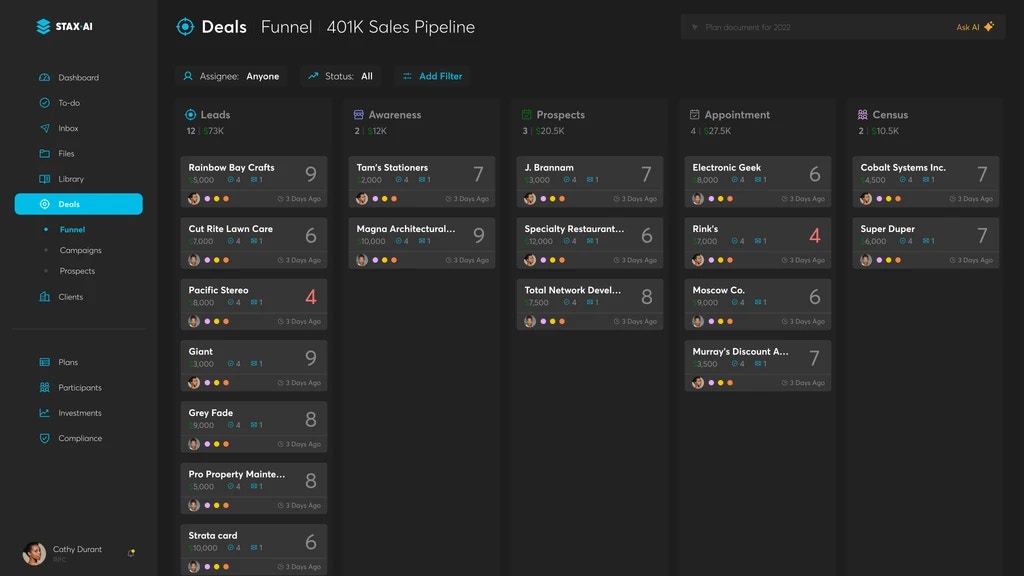

CX introduces a new model for collaboration, one that grants FAs the ability to stay connected to the real-time flow of plan management. The platform’s secure client portal allows FAs to access client data, track plan progress, and view key updates—all without the need for repeated back-and-forth communication with TPAs.

This real-time visibility into plan administration enables FAs to provide timely, informed advice to plan sponsors. Whether it’s tracking census submissions, reviewing compliance testing progress, or monitoring deadlines, FAs can stay fully engaged in the process, enhancing the service they provide to their clients.

Streamlined Communication for Enhanced Collaboration

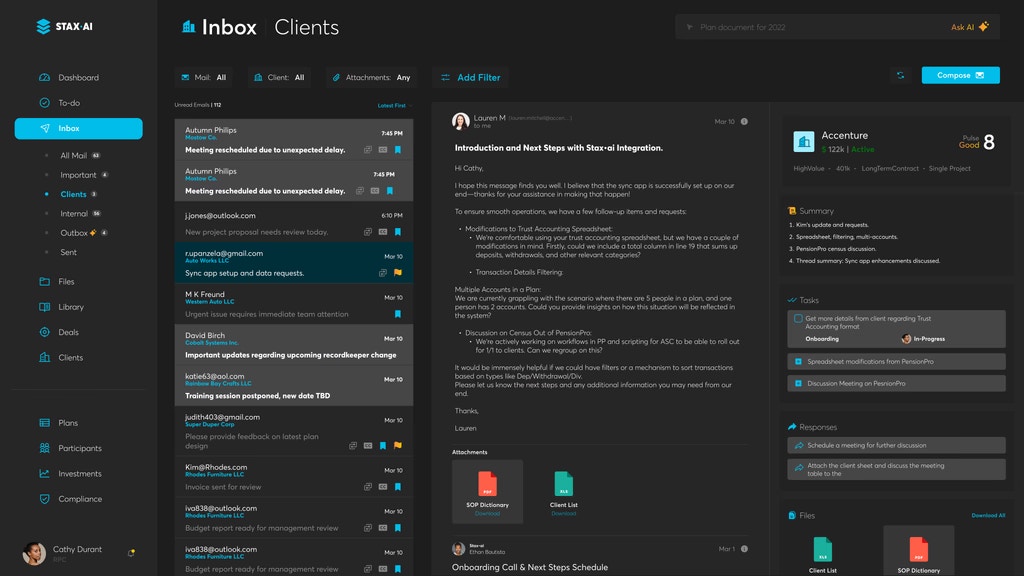

Central to CX’s value is its ability to eliminate the fragmented communication that often hampers the FA-TPA relationship. The platform’s integrated inbox automatically links all client emails to the appropriate records and tasks, ensuring that every interaction is connected to the larger workflow. For FAs, this means never having to sift through disjointed email threads to find relevant updates.

With CX, all communications are streamlined within a single interface, giving FAs immediate access to plan details and reducing the need for manual follow-ups. More importantly, the platform’s AI-powered automation identifies key actions from emails—such as payroll submissions or compliance requests—and converts them into actionable tasks, ensuring that nothing is overlooked.

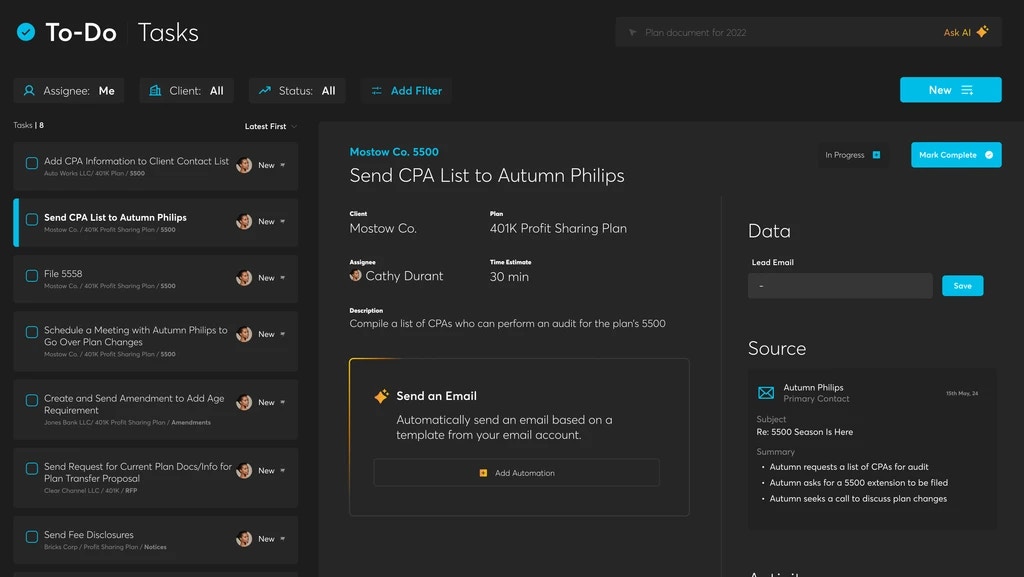

To-Do Tasks

Automated Workflows for Greater Efficiency

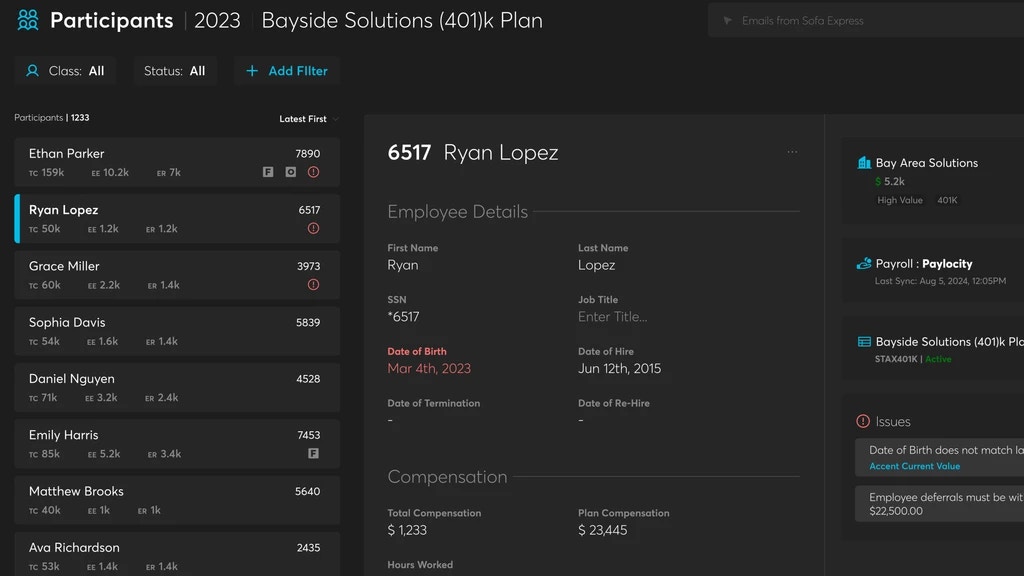

Beyond communication, CX leverages AI to automate critical administrative tasks, allowing FAs to focus on strategy rather than operational bottlenecks. When a TPA processes census data or payroll reports, the platform automatically scrubs the data for errors, generates tasks, and tracks compliance workflows in real time.

This automated process gives FAs full transparency into the progress of plan administration, ensuring they are always up to date on plan status. The ability to track these updates without needing to constantly request information from the TPA allows FAs to stay proactive and offer valuable insights to their clients, all while reducing their reliance on manual updates.

Improving Client Satisfaction & Retention

For FAs, the ultimate goal is to deliver exceptional service that strengthens relationships with plan sponsors. Stax•ai’s CX platform enhances this capability by providing FAs with the tools to stay informed, responsive, and efficient. With real-time access to plan data and automated task tracking, FAs can ensure that their clients are never left waiting for updates or scrambling for information.

Moreover, CX’s pulse score feature offers FAs insights into the overall health of their client relationships by tracking communication frequency, task completion, and client satisfaction metrics. This proactive visibility enables FAs to identify at-risk clients early and take action to address any concerns before they escalate, ensuring stronger client retention.

Looking Ahead: Building a Resilient Advisory Service

As the retirement industry evolves, financial advisors must be equipped with technology that enables them to deliver high-quality service without the operational inefficiencies of outdated systems. CX not only bridges the gap between FAs and TPAs but also builds resilience into advisory services by automating key workflows, enhancing data security, and providing real-time insights into plan management

By leveraging CX, FAs can streamline their collaboration with TPAs, deliver faster, more accurate service to plan sponsors, and position themselves for long-term success in a rapidly changing industry.

Next

Census Data Scrubbing – What a Chore!

Herding Cats: The Art of Change Management

Automate your Census Workflow.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.