Seamless 3(16) Payroll Processing & Compliance

Overview

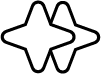

1. Automate Payroll Data Collection

Stax.ai connects directly to 200+ payroll providers, automatically pulling payroll data every pay cycle. Plan sponsors no longer need to manually submit payroll reports, and TPAs receive standardized, validated data in real-time.

Eliminate the risk of missing payroll data, reduce back-and-forth emails, and ensure timely and accurate 3(16) processing.

2. Track 3(16) Tasks with the To-Do Section

Move 3(16) workflows into a structured system. Approve contributions, review eligibility, confirm notices, and track every action automatically—ensuring nothing falls through the cracks and fiduciary duties are fulfilled.

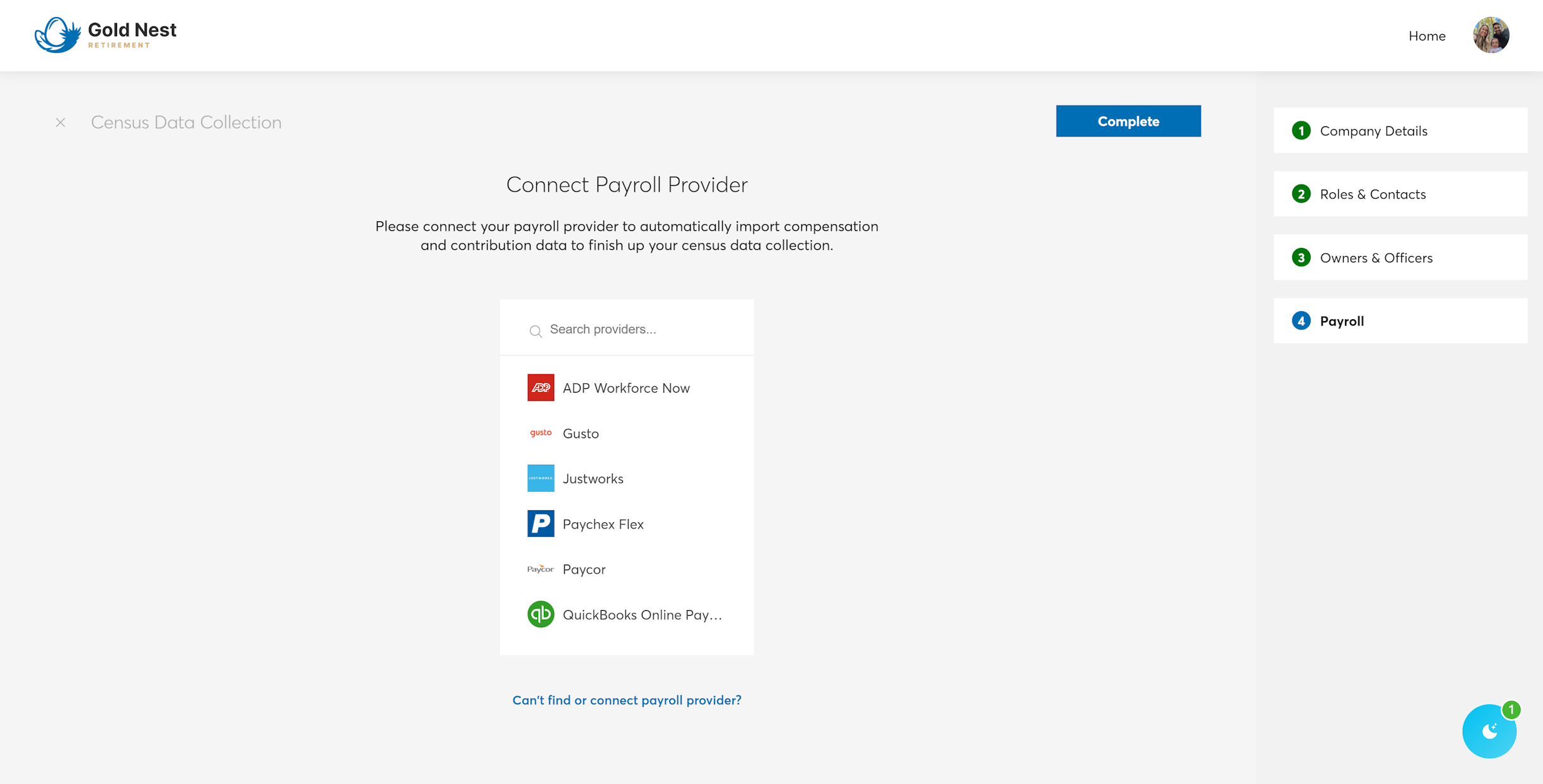

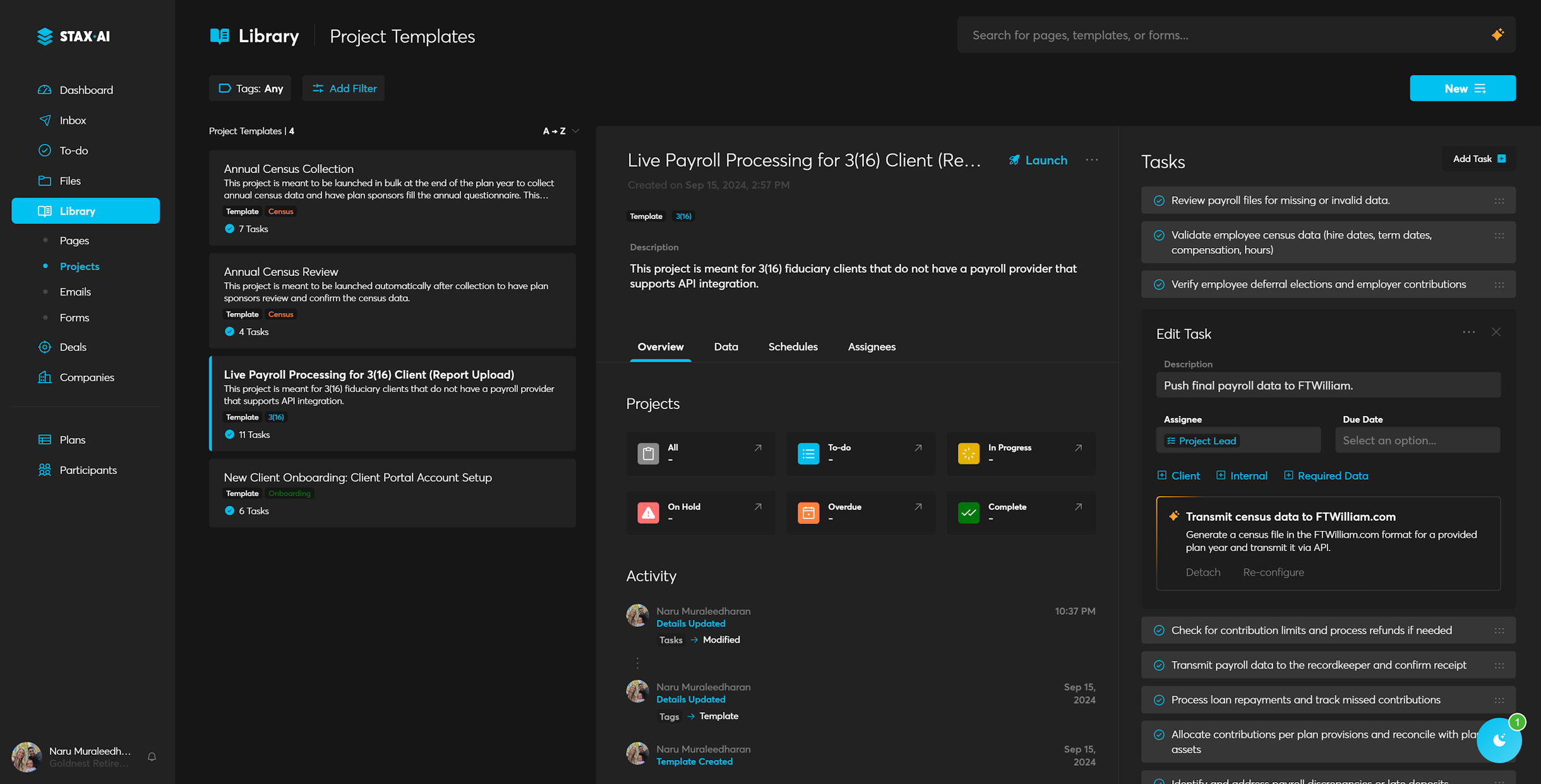

3. Launch Projects Automatically Every Pay Cycle

When new payroll data arrives, Stax.ai automatically launches compliance projects. Each project includes required tasks, deadlines, and built-in validations—ensuring a consistent, reliable compliance process every cycle.

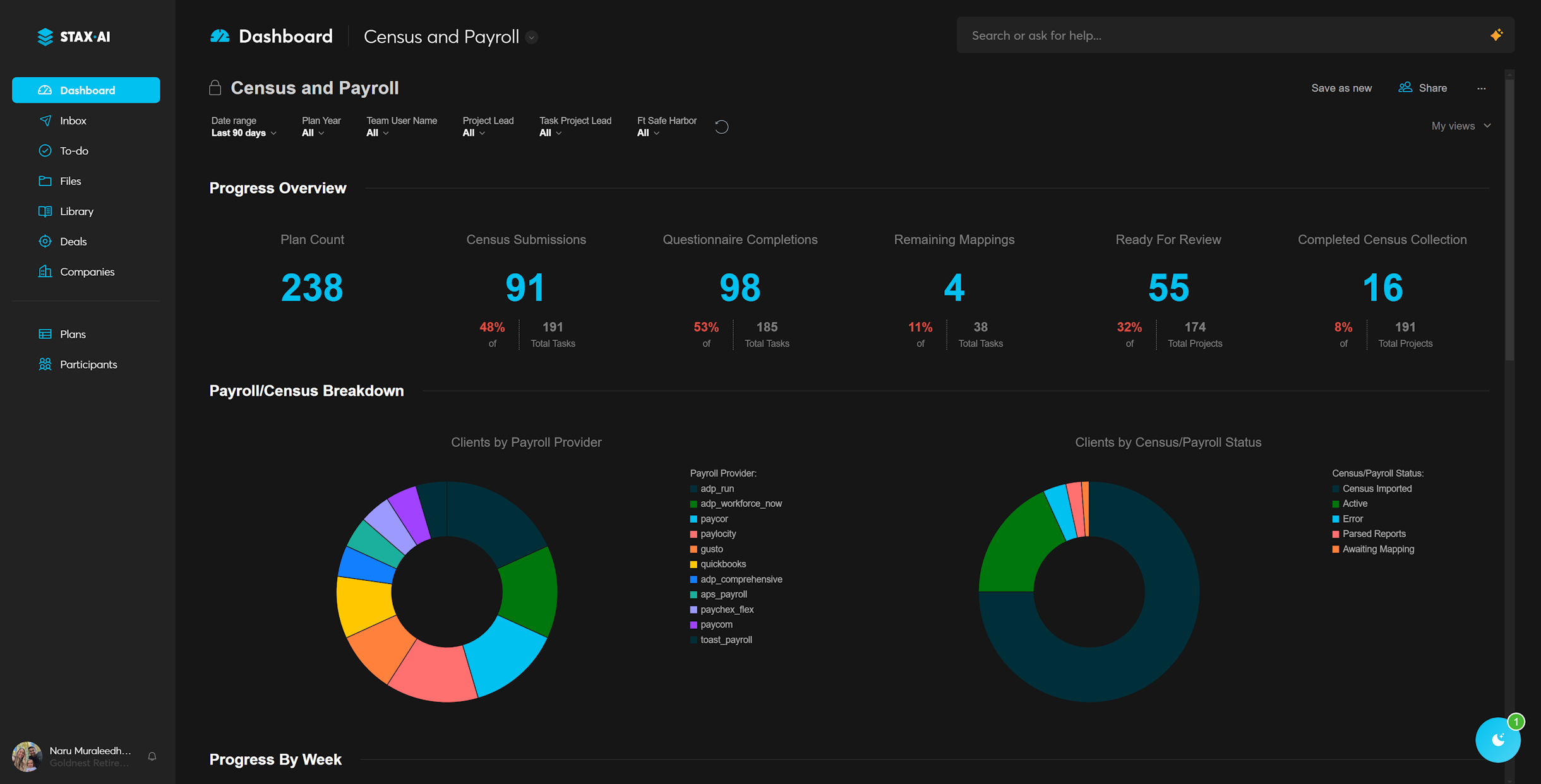

4. Monitor Compliance in Real-Time with the Dashboard

The Dashboard offers a real-time overview of payroll processing and 3(16) compliance tasks. TPAs can instantly see which tasks are pending, completed, or at risk, ensuring proactive management.

Quickly identify compliance risks and act before issues arise, reducing liability and improving efficiency.

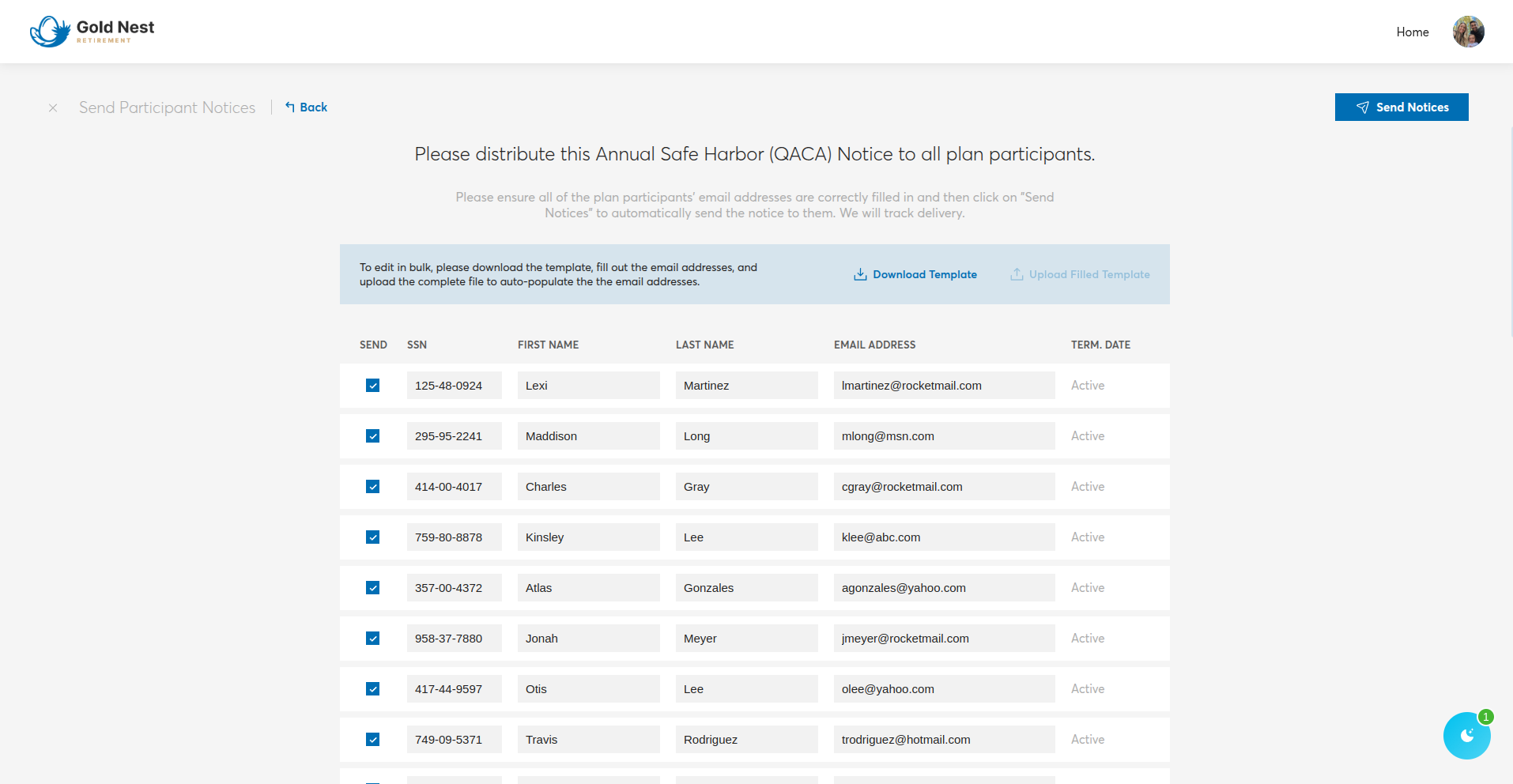

5. Automate Participant Notice Distribution

Generate and distribute required notices (eligibility, deferral, safe harbor, etc.) automatically based on payroll and participant status. Ensure regulatory deadlines are met without manual tracking or document management.

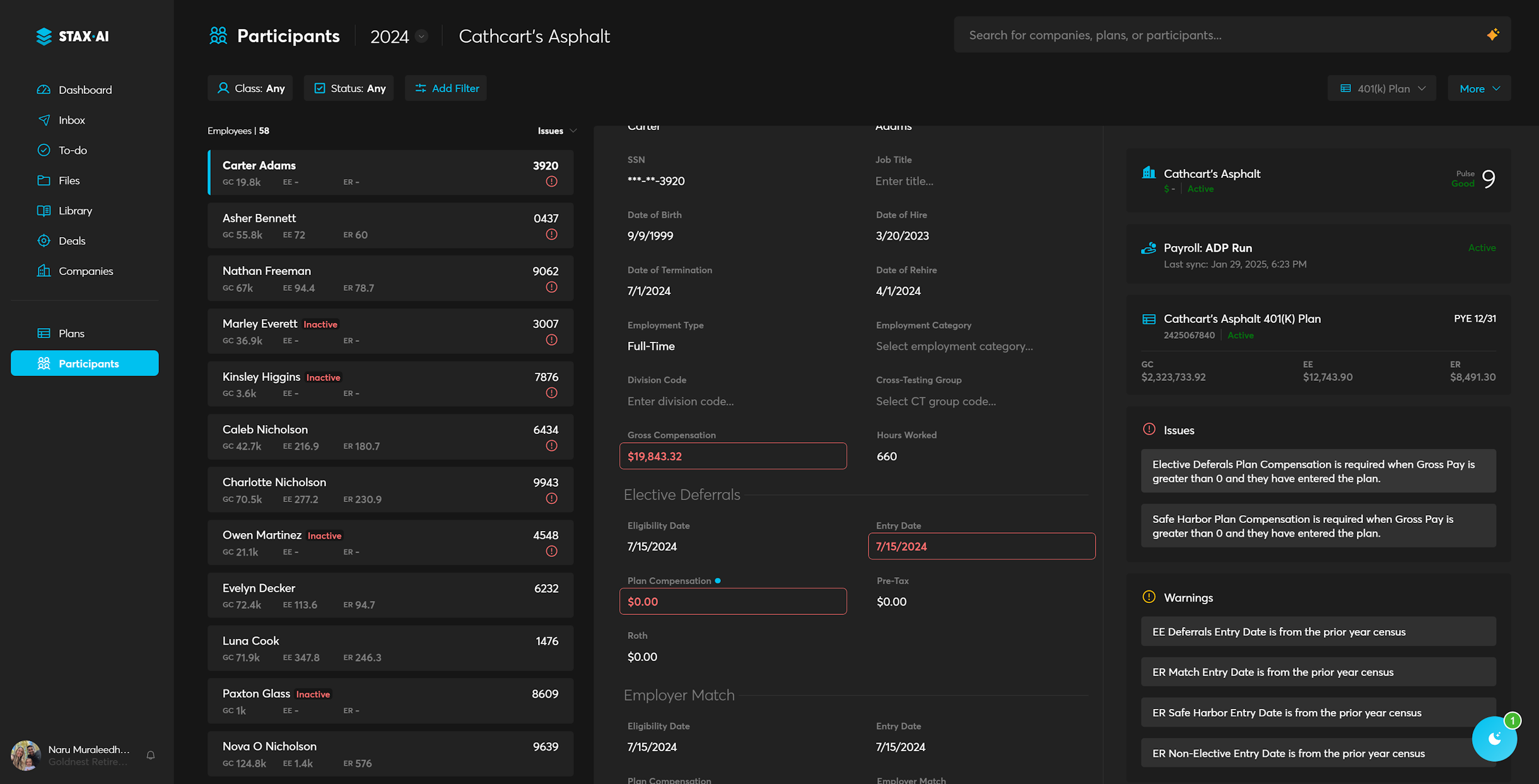

6. Ensure Accuracy & Compliance in Payroll Processing

Stax.ai validates payroll data automatically, flagging missing contributions, incorrect deductions, or inconsistencies before processing. TPAs can review and approve payroll effortlessly.

Minimize errors, ensure compliance with ERISA and DOL regulations, and maintain audit-ready records without manual checks.

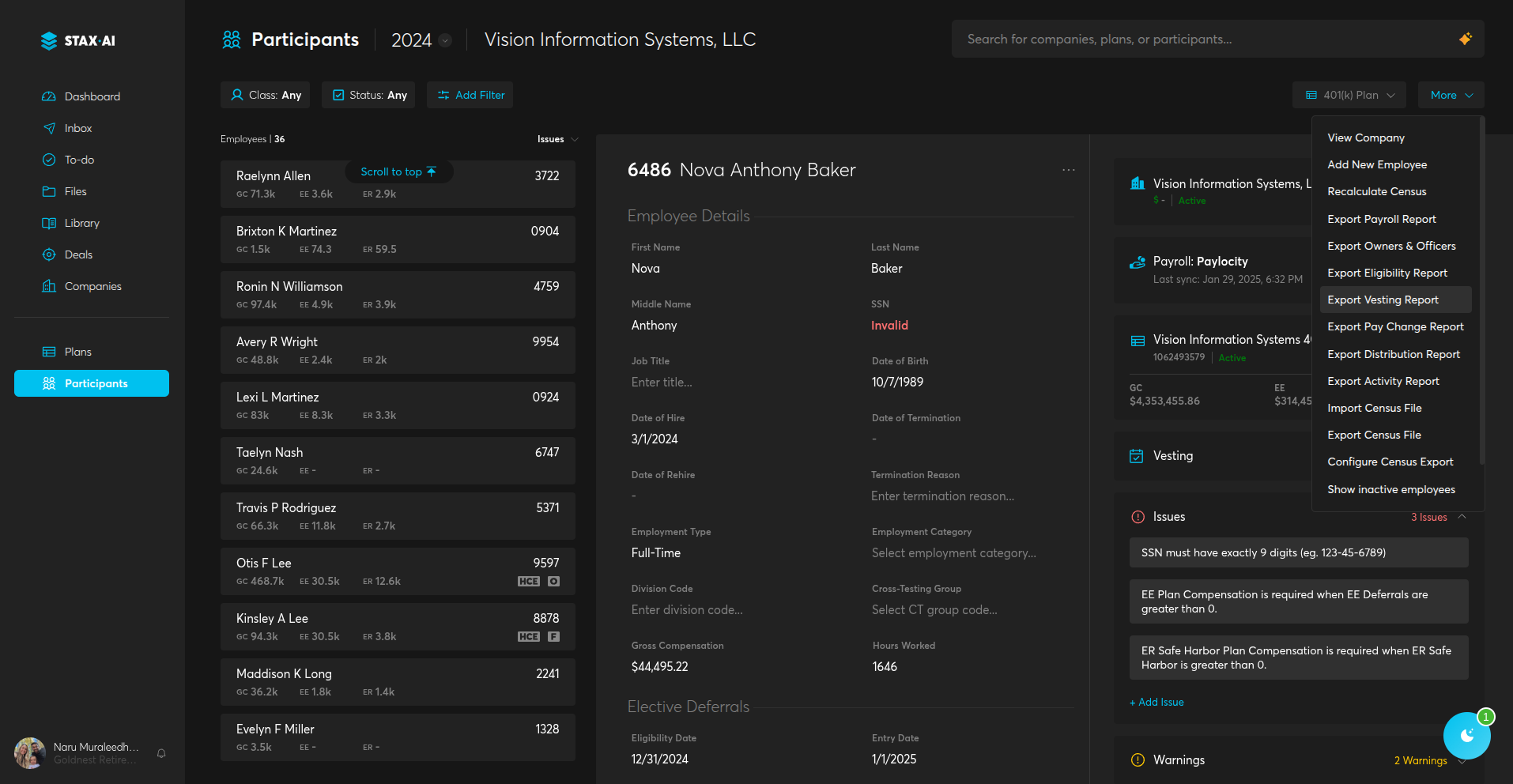

7. Prepare Advanced Compliance Reports Instantly

Create vesting schedules, projected eligibility reports, pay change analyses, and more. Reports are prepared automatically from payroll data, saving hours of manual calculations and improving review accuracy.

Automate your Census Workflow.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.