Before we dive deeper into nondiscrimination testing, let’s revisit some basics.

The 401(k) plan is one of the most popular retirement savings vehicles in America today, helping to provide financial security to millions. According to the Investment Company Institute, there were about 600,000 401(k) plans in 2020 with approximately 60 million active participants—and millions more former employees and retirees. And as of September 30, 2022, these plans held $6.3 trillion in assets, highlighting their important role in helping Americans achieving greater retirement security.

One of the biggest benefits of these plans is their tax advantage—not only for employees, but also for the companies that sponsor them. But for these plans to work as intended, they have to benefit all eligible employees—not just executives and other highly paid folks. At the heart of 401(k) plans—and the compliance tests they must pass--lies the principle of fairness.

For when employees see a plan is truly designed for everyone, not just management, they’re more likely to participate, aiding their retirement readiness and boosting morale.

Testing is all about fairness – 401(k) plans are for

everyone – the tests are there to make sure they are!

But Uncle Sam doesn’t just take a company’s word. To keep its tax-advantaged status and prove their plan’s fairness, companies must pass annual non-discrimination tests--the best-known of which are the Actual Deferral Percentage (ADP) and Actual Contribution Percentage (ACP) tests.

These tests verify that contribution rates, while not necessarily identical between non-highly compensated employees (NHCEs) and highly compensated employees (HCEs), don’t unduly favor HCEs and provide equitable retirement savings opportunities to all.

But wait, who’s an HCE, anyway? Any employee who:

Owns more than 5% of the company (either directly or through their family) at any time in the current or previous year, regardless of income

Earns more than the IRS threshold (e.g., $160,000 in 2025; $155,000 in 2024) or, if the “Top Paid Group Election” applies, is in the top 20% of employees by compensation

Anyone is an NHCE—easy enough, right?

Timing

ADP/ACP tests are generally run early every year, usually in January or February for calendar year-end plans—with corrections to be made by March 15th to avoid penalties, including a 10% excise tax.

It’s simple – really! Just take it step by step!

The Actual Deferral Percentage (ADP) Test

This test compares salary deferrals between HCEs and NHCEs to verify that HCEs don’t defer significantly higher percentages of their pay compared to NHCEs. This includes pre-tax and Roth deferrals but not catch-up contributions.

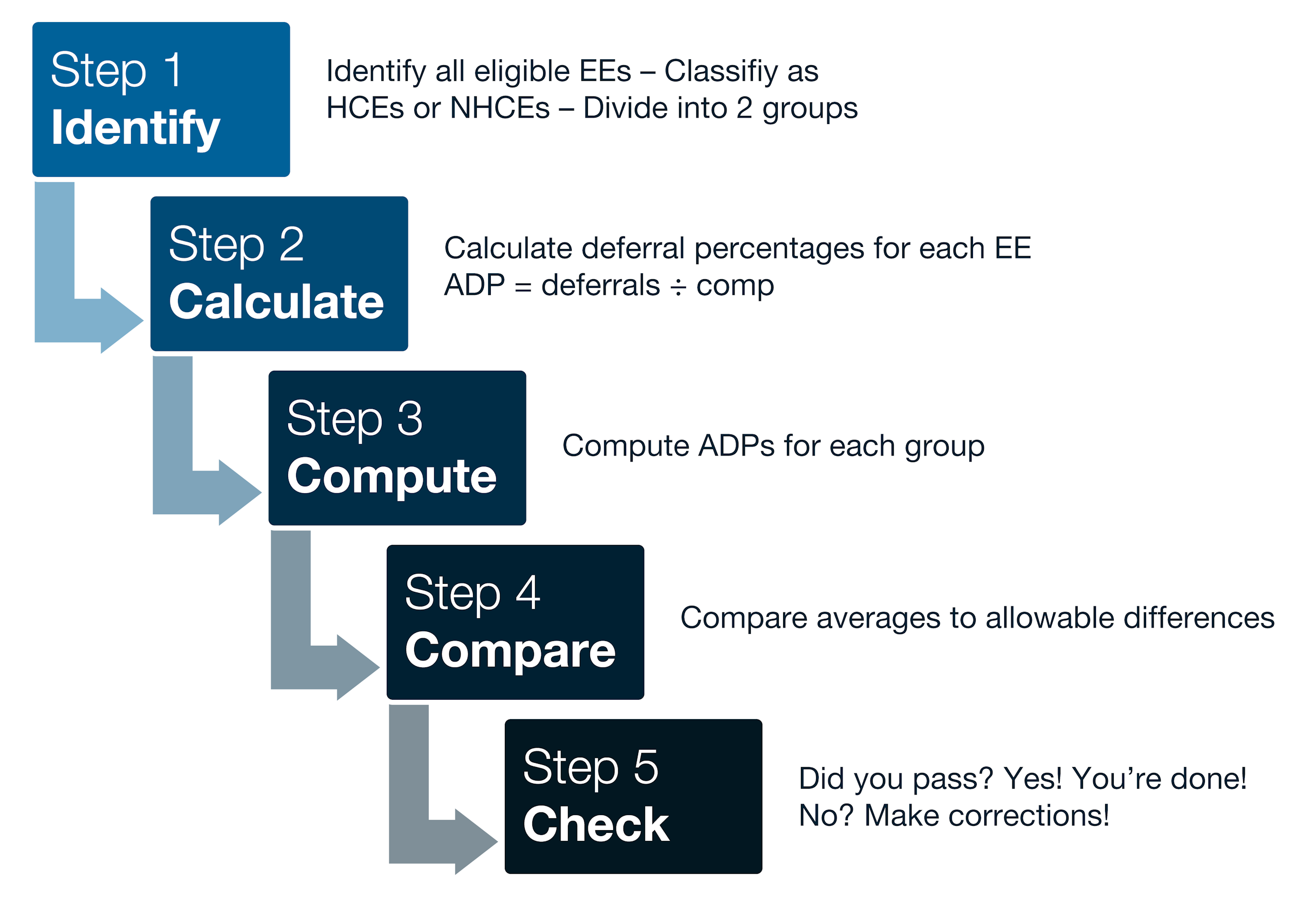

How to Run the ADP Test

It can be complicated, but here’s a simplified step-by-step chart to help:

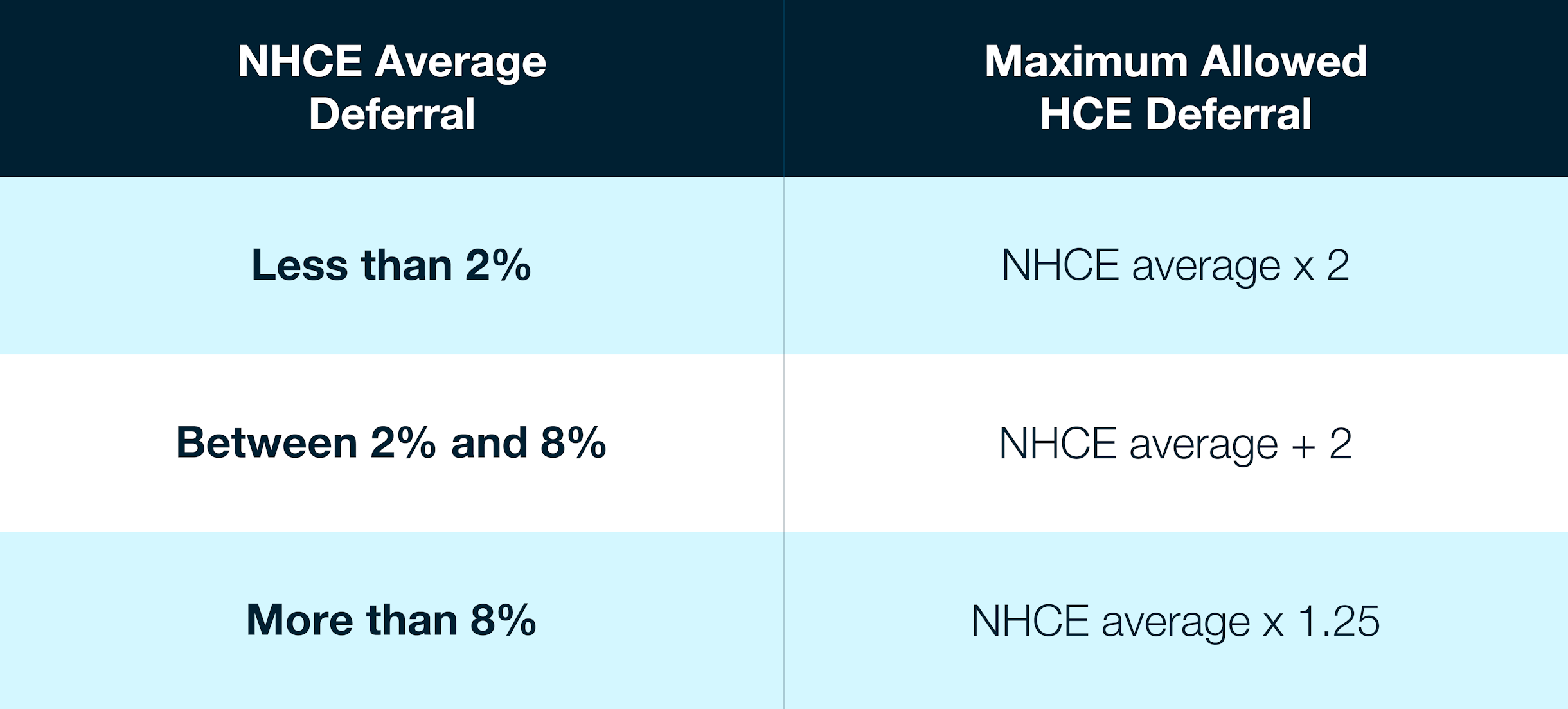

Allowable Differences Chart

To pass the test, the average deferral rate for the HCE group must be within a certain range, or spread, of the NHCE group’s average, as shown below; the ideal spread is 2%.

If HCE deferrals exceed these limits, the plan fails. And if your plan fails the test, you have to take corrective action to avoid losing the plan’s tax-qualified status.

Passing is not an option – take corrective action –

immediately!

The Actual Contribution Percentage (ACP) Test

The ACP test is similar to the ADP test except it looks at employer matching and employee after-tax contributions to ensure they don’t disproportionately favor HCEs. Just replace employee pre-tax deferrals with company matching and employee after-tax contributions in the formula.

Making Sense of The Results

Pass: Congratulations! You’re done for the year.

Fail: Don’t panic—there are steps you can take.

Correcting Failures

Failed your test? You’re not alone. About 30% of small business 401(k)s fail at least one of these tests every year.

So, take a deep breath. Then get to work.

Step 1 - Review data accuracy: employee classifications, inclusion of eligible employees, and the definitions of compensation. If it’s not correct, fix it, and rerun the test.

Step 2 - Consult Professionals. Consult an advisor or 3(16) fiduciary for alternative testing methods.

Step 3 - Take Corrective Action—Right Away:

Corrective Distributions: The most common correction method is to refund excess HCE contributions until the plan passes the test. The distributions must be made by March 15 for a calendar year-end plan. Needless to say, this is not very popular with HCEs, though necessary.

Qualified Non-Elective Contributions (QNECs): Additional employer contributions to all NHCEs to fix ADP failures. The same percentage of compensation must be given to each NHCE regardless of how much they deferred to the plan, and the contributions are always 100% vested.

Qualified Employer Matching Contributions (QMACs): Employer matching contributions to fix ACP failures. They are made as a percentage of the employee’s elective deferral. QNECs and QMACs can be used interchangeably to correct ADP and ACP test failures, just not both in the same year.

Avoiding Future Failures

Increase NHCE participation with education programs and enrollment meetings.

Implement automatic enrollment and auto-escalation features as outlined in your plan document.

Adopt a safe harbor plan design (they automatically pass non-discrimination tests) with mandatory employer contributions and participant notices.

Did your plan pass?

If not—or just barely, contact Stax.ai. We help ensure your participant data is accurate, the critical first step in passing these “pesky” tests. Plus, we offer ongoing support. Don’t wait—call us today!

Next

Personalized Services are The Secret Weapon for TPAs in a One-Size-Fits-None World

Streamlining Retirement Plan Management Effortlessly

Automate your Census Workflow.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.