In the fast-paced world of retirement plan administration, relying on static AI models is akin to navigating a highway with yesterday’s map. Traditional large language models (LLMs) are trained on fixed datasets that quickly become outdated, leading to misguided recommendations - or “hallucinations” = when regulations shift or plan provisions change. This disconnect not only undermines user trust but also exposes TPAs to compliance risks and operational bottlenecks.

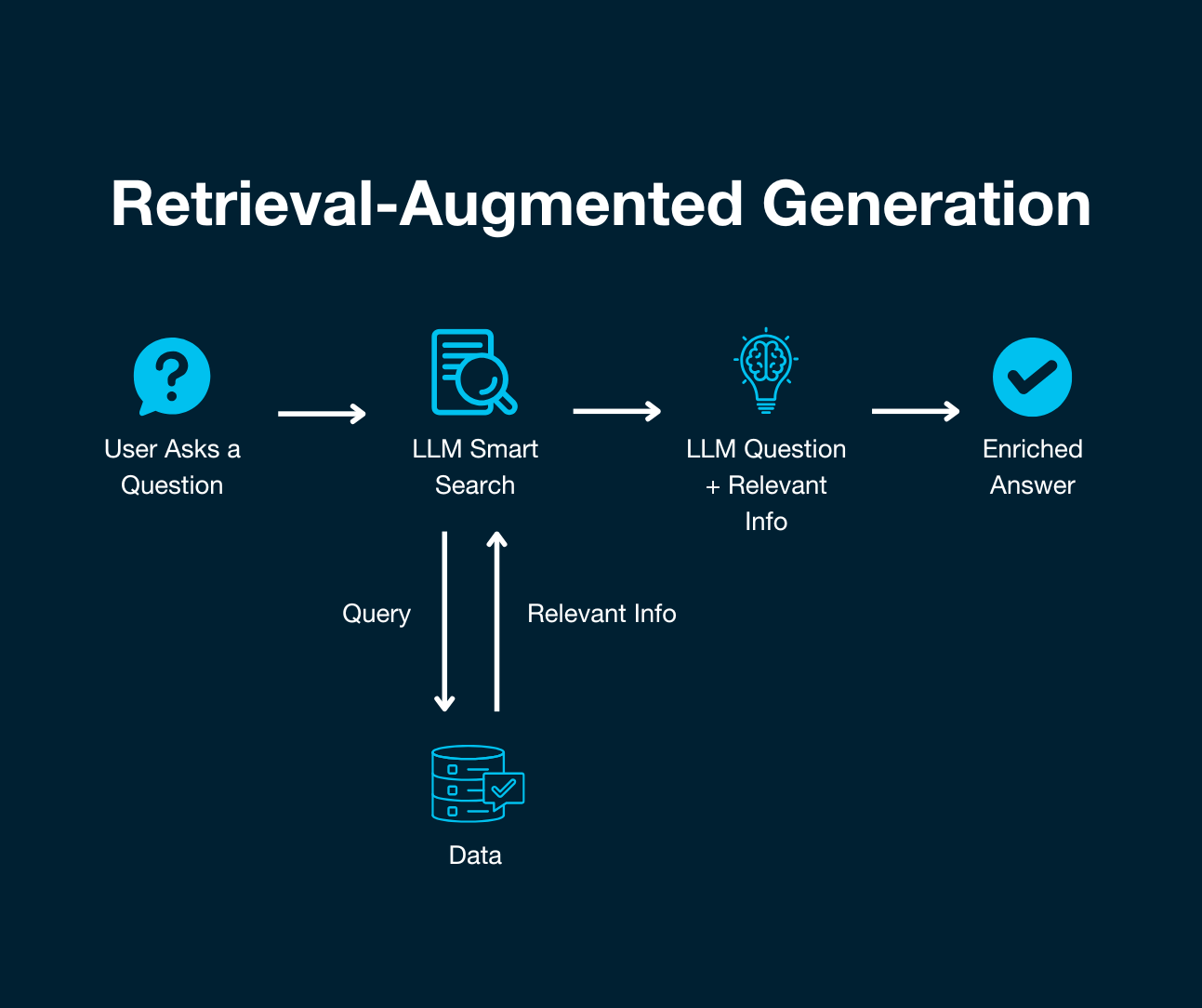

Retrieval-Augmented Generation (RAG) offers a dynamic solution by seamlessly integrating real-time data retrieval into the AI workflow. At query time, RAG fetches the latest IRS bulletins, Department of Labor guidelines, and internal plan documents, injecting fresh, authoritative context into the model’s prompt. The result is a confident, up-to-date assistant that delivers factually grounded insights and keeps pace with the ever-evolving regulatory landscape.

Why RAG Matters for TPAs

Retirement plan administrators operate in an environment defined by complexity and rapid change. First, regulatory flux is constant: new guidance from the IRS or DOL can materially affect plan compliance, testing, and reporting requirements. Manually tracking these updates is labor-intensive and error-prone.

Secondly, participant expectations have shifted - today’s plan members expect instant, personalized service rather than generic FAQ responses. TPAs handle vast volumes of heterogeneous data, from census files to financial statements. Traditional processes struggle to synthesize and surface relevant insights, leading to bottlenecks and elevated risk. RAG offers a path to address each of these pain points by automating knowledge retrieval, enhancing decision accuracy, and scaling responsive support.

What Is RAG?

At its core, RAG augments an LLM with a retrieval component. When a user query is submitted, the system issues a search against indexed data sources - these might include regulatory websites, document repositories, or proprietary databases. The top-ranked passages are then concatenated with the original prompt, forming an enriched input for the LLM. After this,, the model generates a response that explicitly references the retrieved context, ensuring traceability and factual integrity.

What’s the difference between RAGs and Traditional LLMs?

Where traditional LLMs operate like static encyclopedias - accurate only up to their training cut-off, RAG-enabled models function as living experts. They draw on the latest information, whether that’s a newly published DOL notice or an updated set of plan provision options in the current cycle of documents. This real-time grounding drastically reduces the risk of hallucinations and eliminates the need for costly, periodic model retraining to incorporate domain-specific data. Moreover, by recording the source of each snippet, RAG systems offer audit trails that are essential for compliance and governance in high-stakes financial environments.

Key Advantages of RAG

Improved Accuracy & Currency

RAG systems automatically fetch the most current regulatory bulletins, plan amendments, and market data, ensuring that AI outputs reflect today’s realities. By continuously integrating fresh data, TPAs can trust that generated advice aligns with the latest legal and operational parameters.

Reduced Hallucinations

Traditional generative models can produce plausible-sounding but incorrect information when asked beyond their knowledge scope. RAG mitigates this by anchoring responses to factual passages. When the model synthesizes an answer, it explicitly cites the retrieved text, allowing users to verify claims and strengthening confidence in AI-driven decisions.

Domain Specificity without Retraining

To tailor an AI’s knowledge to a specialized domain, conventional approaches demand extensive retraining on proprietary datasets - a process that is both time-consuming and resource-intensive. RAG bypasses this requirement: simply index your internal plan documents, test results, and client communications. The retrieval layer will surface relevant content on demand, delivering personalized insights without model retraining overhead.

Enhanced Governance & Compliance

RAG’s citation mechanisms provide a transparent audit trail for every recommendation. Compliance officers can trace each assertion back to its source document, whether an IRS guidance memo or a client’s plan SPD. This feature is critical for satisfying regulatory audits and internal governance standards, ensuring that AI-assisted processes remain fully accountable.

When to Choose RAG

In evaluating AI for TPA operations, consider the following dimensions:

- Regulatory Compliance

- Participant Experience

- Reporting Workflows

- Maintenance Overhead

- Stale knowledge risks non-compliance

- One-size-fits-all responses

- Manual assembly of data

- Periodic retraining or manual updates

- Live retrieval ensures up-to-date compliance

- Contextual, individualized answers

- Automated narrative reports with live data

- Continuous index refresh, minimal retraining

When real-time accuracy and auditability are paramount - such as generating compliance test reports or answering participant queries about contribution limits - RAG-enabled solutions deliver clear advantages over standalone LLMs.

Applications of RAG for TPAs

Enhanced Compliance Monitoring

A RAG-driven system can automatically ingest new IRS and DOL bulletins, cross-check them against each plan’s provisions, and generate updated compliance testing reports. Alerts notify administrators of any discrepancies, reducing manual review cycles.

Personalized Participant Support

Chatbots powered by RAG can fetch participant-specific data - such as employment dates and vesting schedules - alongside relevant regulatory context. When a participant asks, “What’s my current vesting percentage?” the system provides an accurate, cite-backed response, elevating user satisfaction and trust.

Automated Reporting & Analysis

TPAs can automate the creation of sponsor reports and benefit statements. RAG pipelines can retrieve the latest plan metrics - performance figures, census updates, testing outcomes - and craft narrative summaries that highlight key insights, saving hours of manual drafting.

Intelligent Plan Design Assistance

By indexing historical plan performance and industry benchmarks, RAG systems can recommend plan features that drive better outcomes. For example, analysis of auto-enrollment rates across similar clients could reveal optimal default settings, enabling TPAs to propose designs grounded in empirical evidence.

Proactive Risk Management

Continuous retrieval of transactional data and external indicators allows RAG to flag anomalies - late contributions, unusual loan distributions, or fund performance drifts - before they escalate. This proactive approach empowers fiduciaries to address issues early and maintain plan integrity.

Key Considerations for Implementation

Data Privacy & Security:

Encrypt data at rest and in transit, enforce strict access controls, and validate vendor compliance certifications (e.g., SOC 2, HIPAA) to protect participant information.

System Integration:

Plan for API-based connectors or RAG accelerators that embed seamlessly into your TPA software stack, avoiding the creation of isolated AI silos.

Ongoing Maintenance:

Establish processes to update knowledge indexes, deprecate outdated documents, and monitor performance metrics - accuracy rates, retrieval latency, and user feedback.

Governance & Training:

Train staff on RAG capabilities and limitations. Define oversight workflows where compliance officers review AI-generated outputs and establish escalation paths for ambiguous queries.

How Stax.ai Leverages RAG

Stax.ai’s platform embeds RAG at every layer to provide TPAs with a secure, scalable AI co-pilot:

AI-Powered Census Cleansing: Automatically ingest and normalize participant census data, correcting errors and filling gaps using retrieval from prior submissions and plan templates.

Pre-Built Connectors: Seamless APIs integrate with recordkeeping systems, document repositories, and CRM platforms, eliminating data silos.

Source Attribution: Every AI suggestion includes source references, making audit and compliance straightforward.

Dynamic Reconciliation Assistant: Compare brokerage statements and trust accounting records in real time, fetching transaction details on demand to streamline discrepancy resolution and audit prep.

Governance Controls: Role-based access and human-in-the-loop review workflows ensure AI outputs align with your policies.

How Stax.ai Can Help

Stax.ai powers your RAG journey by handling the complexity of data integrations, compliance updates, and AI orchestration - so your team can focus on strategic decision-making, not manual processes. Our unified platform seamlessly integrates with your existing workflows, indexes critical retirement-plan data, and delivers actionable insights with simple setup.

Effortless Data Integration: We connect to your recordkeeping systems, census feeds, and document repositories, normalizing disparate data sources into a single, searchable index.

AI-Driven Workflow Automation: From census cleansing to reconciliation and reporting, Stax.ai automates end-to-end processes, reducing manual effort by up to 80% and eliminating repetitive tasks.

Scalable, Secure Deployment: Backed by SOC 2 compliance, role-based access controls, and enterprise-grade encryption.

Get Started Today: Talk to your Stax.ai representative to schedule a demo, launch a pilot, and see how RAG-driven automation can transform your retirement plan administration workflows.

Next

Migrating from PensionPro to Stax.ai CX: A Faster, Easier Path for TPAs

Streamlining Retirement Plan Management Effortlessly

Automate your Census Workflow.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.