Long before Sesame Street, there was a freckle-faced puppet named Howdy Doody who was the star of his own show for kids. Every afternoon the show opened with his sidekick Buffalo Bob leading an audience of 50 children in the Peanut Gallery singing, “It’s Howdy Doody Time! It’s Howdy Doody Time. It’s time to start the show, so kids let’s go!”

Howdy Doody has been gone for over 40 years, but his last “so kids let’s go!” still lingers on… to be repeated by TPAs everywhere in late spring as they tell their clients, “It’s 5500 time, so let’s go!”

It’s 5500 Time, so let’s go!

It’s late spring, almost summer. As a TPA with a lot of 401(k) plans to administer, you know what that means – employee benefit plan (EBP) audits. They’ve been in full swing for a couple of months now. The 5500 filing deadline looms near.

You’ve been through this drill before, why are you still concerned? And why the sleepless nights?

Worrying about 5500s? The 5 W’s and the H have answers.

First, a quick look at the 5500 using the fundamental 5 “W” questions of reporting: who, what, where, when, why, plus an “H,” how:

Who wants the 5500? Uncle Sam, specifically the IRS and DOL (Department of Labor and its Employee Benefits Security Administration department). They’re interested in the health of retirement plans, their finances, and employee participation.

What is a 5500? It’s an annual report that’s required to be filed by certain types of retirement plans such as 401(k)s subject to ERISA. The 5500 gives the IRS and DOL important details about the financial condition, investments, operations compliance, qualification, and participant counts of a 401(k) plan.

Where is the 5500 sent? All 5500s are filed electronically via the DOL’s EFAST2 system; both the IRS and DOL receive copies. TPAs can file for their plan sponsor by registering with their plan sponsor’s credentials and following the submission instructions.

When is the 5500 deadline? The filing deadline is seven months after the end of the plan year. For plans ending on December 31, that means the 5500 is due by July 31, with a two-and-a-half-month extension to October 15 available.

Why is the 5500 required? It was developed by three government agencies – IRS, IRS, DOL, and PBGC – as an important tool to ensure your plan complies with federal regulatory requirements and to provide plan participants and beneficiaries with important information about their plan.

How is the 5500 prepared? By collecting plan data, financial information, and compliance testing results, verifying their accuracy, and putting them all together with supporting attachments.

Hey! Wait! Don’t forget me – the Summary Annual Report (SAR)! The SAR is a participant-friendly summary of the 5500, helping keep employees informed and fostering transparency.

Show Mechanics

Now that we’ve covered the basics of what a Form 5500 is and why it matters, let’s dig a little deeper into the mechanics of preparing one. First a look at the form itself and its variations.

Forms

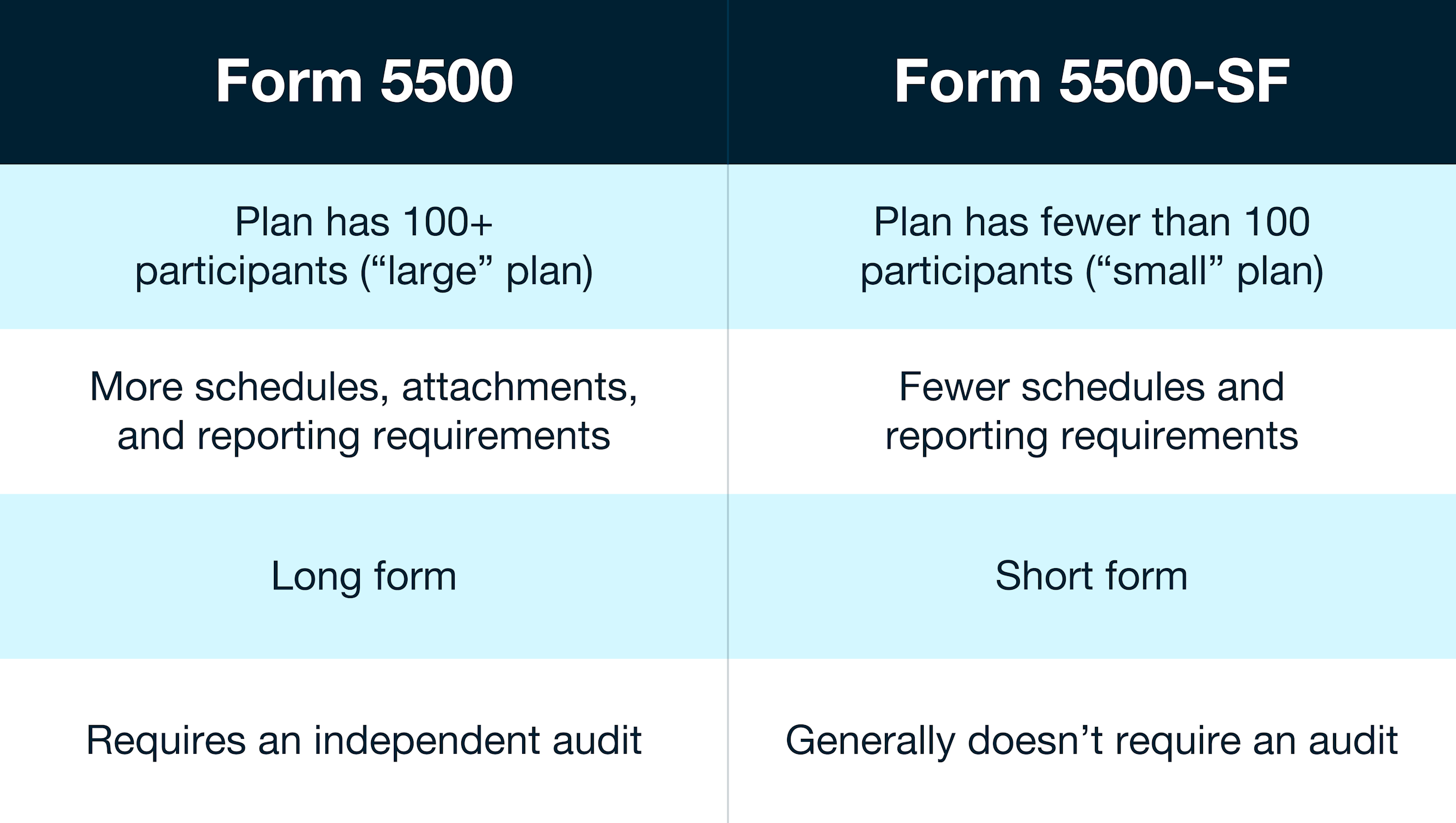

The 5500 comes in more than one type. The form you use depends on the size of your plan, whether it’s “large” or “small.” What’s the difference? It’s the number of participants with account balances at the start of the plan year, including active and terminated participants and beneficiaries.

Additionally, owner-participant plans can file a much-simplified Form 5500-EZ if they meet certain requirements.

Note: If the plan has between 80 and 120 participants, exceptions may allow choosing which form to file – check with your preparer.

5500 Schedules

For large plans the 5500 is three pages long and includes separate schedules and attachments that supplement the main form. Which schedules are required depends on the plan’s characteristics.

Schedule A (Insurance Information): Details insurance contracts purchased by the plan.

Schedule C (Service Providers): Lists fees paid to service providers.

Schedule G (Financial Transactions): Reports certain financial transactions such as loans, leases, and sales or exchanges of assets.

Schedule H (Financial Information): Breaks down financial details like assets, liabilities, and income for large plans.

Schedule I (Financial Information): Provides simplified financial details for small plans.

Schedule R (Retirement Plan Information): Covers plan operations, distributions, and plan terminations.

Additionally, defined benefit plans must include two more schedules:

Schedule SB (Actuarial information

Schedule MB (Multiemployer plan information)

Audits

As the chart above indicates, “large” plans – with 100 or more participants with account balances – must have an independent audit included with their 5500 filing. The audit is conducted by a certified public accountant who reviews the plan’s financial statements and compliance to ensure accuracy.

Audits add complexity and cost but are crucial to protect participant benefits and maintain the plan’s tax-qualified status. Smaller plans filing the 5500-SF generally don’t need an audit.

Errors are avoidable! Check – check – and double check before filing!

Common Filing Errors

Accuracy on the 5500 and schedules is critical; errors may trigger a DOL audit, which is costly and time-consuming. Common errors include:

Incorrect plan year

Errors in plan sponsor information

Errors in participant headcounts

Incorrect 5500 form type

Missing or incorrect schedules

Missing audited financial statements

Incomplete or inaccurate financial data (assets, liabilities, contributions, distributions)

Outdated plan documents and amendments

It’s so-o-o-o easy to make mistakes handling large volumes of participant and financial data. You can avoid errors by verifying the completed 5500 and schedules before filing them, including:

Double-checking plan sponsor information (EIN, dates)

Cross-checking participant counts against payroll data and plan records

Understanding which schedules apply and their purpose

Reviewing financial information thoroughly

Always keeping plan documents and amendments current

Maintaining data consistency

Written policies with deadlines and team responsibilities help, along with robust verification processes.

Don’t be late! It’s expensive!

Late Filing Penalties

The 5500 filing deadline is non-negotiable. Missing it can lead to severe penalties from both agencies, though the DOL offers some relief through its Delinquent Filer Voluntary Correction Program (DFVC) if certain requirements are met:

IRS penalties of $250 per day, up to a maximum of $150,000

DOL penalties up to $2,529 per day, with no maximum

This hardly sounds like the fun of a Howdy Doody show! Preparing 5500s is time-consuming and data-intensive, but with strong processes and expert support, it doesn’t have to keep you up at night.

Stax.ai Makes 5500s Easier

One of Stax.ai’s greatest strengths is its ability to gather and scrub data for accuracy. Its CX platform takes the headache out of managing data and paperwork, no matter how high the mountain may be:

Automated data collection. Rapidly gather data with accuracy and completeness the first time, avoiding repeated requests.

Centralized Document Management: Store all crucial files and reports in one spot for quick, easy access.

Real-Time Compliance Checks: Scan reports for errors early, so nothing slips through the cracks.

Audit-Ready Reporting: Keep your records neat and ready, cutting down time and stress.

Final thoughts

Stax.ai helps TPAs and plan sponsors confidently manage accurate, compliant, and efficient 5500 preparations, especially for the data-heavy audits large plans require.

Need help mastering the mountain of records essential for 401(k) plan administration? Streamlining that detail-heavy workload is what Stax.ai does best.

Next

PensionPro Reporting vs. Modern TPA Analytics: Why Built-In, Real-Time Dashboards & Analytics Wins

Smarter Choices: New Ways to Pick 401(k) and Retirement Plan Software That Actually Work

Automate your Census Workflow.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.

Simplify annual census collection through effortless payroll data gathering and automated scrubbing based on plan document provisions.