Managing client onboarding, census collection, and compliance testing is a weighty undertaking for any TPA. The desire to retain a high-touch, customer-centric approach to every step of the client’s journey is top of mind. Yet, the already hefty challenge grows more difficult as the regulatory landscape tightens and client expectations evolve. As a result, traditional onboarding methods—often reliant on manual processes and fragmented tools—have proven insufficient. The need for a more integrated, efficient approach is no longer an option; it is a necessity.

CX offers TPAs a comprehensive, white-label client portal designed to streamline these processes. By automating census collection, facilitating payroll integration, and ensuring secure document exchange, the portal not only simplifies onboarding but also enables TPAs to deliver a more responsive, scalable service. This shift marks a fundamental change in the way TPAs manage their operations—moving away from reactive, manual workflows to a fully automated, proactive model.

For TPAs, onboarding new clients has traditionally been a disjointed process. Plan sponsors are often required to fill out extensive spreadsheets, submit sensitive data through insecure channels, and engage in multiple back-and-forth communications to complete onboarding. Each of these steps presents an opportunity for errors—whether in misreported data, outdated details, or misplaced documents. More critically, this fragmented approach delays the speed of service and increases compliance risks.

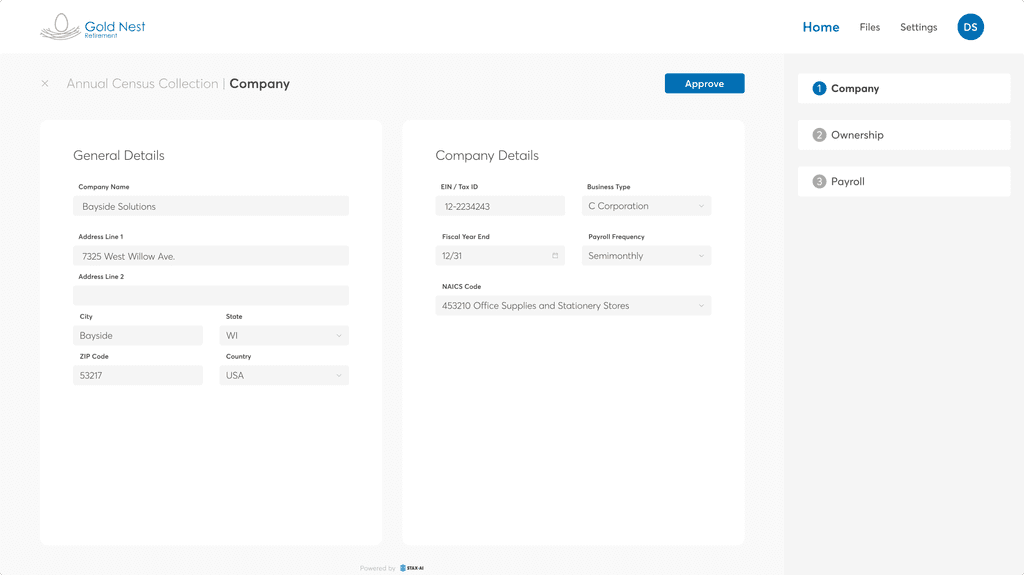

Our client portal transforms this process by consolidating all client interactions within a single, secure environment. Instead of sending spreadsheets or relying on emails, plan sponsors can now update company details, review owner information, and upload sensitive payroll data directly into the portal. The system automates these workflows, ensuring consistency, security, and accuracy from the very beginning of the client relationship.

Central to the platform’s efficiency is its approach to census collection and review. Annual census collection—often a time-consuming and error-prone task—is simplified into a three-step process that uses prepopulated data from prior years. Plan sponsors no longer need to manually enter repetitive data. Instead, they can focus on updating relevant information, such as changes in ownership or payroll details.

The portal automatically scrubs the submitted data for errors, flagging inconsistencies and discrepancies before they can affect compliance testing. This automated data validation ensures that TPAs receive clean, accurate census files, ready for compliance workflows without the usual back-and-forth corrections.

For TPAs, this shift translates into reduced manual workloads and a dramatic improvement in data quality. Unlike traditional methods, where errors might go unnoticed until the compliance stage, CX identifies and rectifies these issues in real time. This proactive approach ensures that census data is both accurate and compliant from the outset.

From its inception, we’ve prioritized data security, anticipating the increasing demands of a stringent regulatory environment. This foresight has positioned us as a leader in the secure exchange of sensitive payroll and census information, fully compliant with SOC 2 Type II standards.

Unlike unsecured methods such as email or third-party file-sharing services, CX offers a secure environment for document exchange between TPAs and plan sponsors. Each interaction is tracked, generating a verifiable audit trail that strengthens compliance efforts. This high level of data security, combined with seamless file exchange, distinguishes us from traditional, risk-prone onboarding solutions.

Perhaps the most transformative feature of the client portal is its real-time compliance monitoring capabilities. Once the census data is scrubbed and validated, CX automatically transmits it into the TPA’s compliance workflows. The platform’s AI-driven algorithms monitor for potential compliance risks, proactively identifying issues before they escalate into regulatory violations.

Plan sponsors and TPAs can track the progress of compliance testing in real time, reducing the need for periodic manual reviews. This automation allows TPAs to focus on higher-value activities, such as client advisory services, rather than becoming bogged down in the minutiae of data entry and error correction.

The shift to a fully automated, integrated platform doesn’t just streamline operations—it builds resilience. By automating critical processes like onboarding, census collection, and compliance testing, TPAs can mitigate the risk of human error and enhance operational scalability. The portal’s real-time monitoring, secure document exchange, and automated data validation ensure that TPAs are always in compliance, while minimizing the workload on their teams.

The white-label nature of the portal also enables TPAs to offer a fully branded experience to their clients, reinforcing their identity while leveraging cutting-edge technology.

As TPAs continue to navigate an increasingly complex regulatory environment, adopting a solution like CX isn’t just about improving current workflows—it’s about future-proofing operations. The platform’s ability to automate manual processes, provide real-time compliance insights, and ensure data security positions TPAs to meet the growing demands of both regulators and clients.

CX’s client portal offers a transformative approach to TPA services, allowing administrators to streamline onboarding, enhance compliance, and deliver a more efficient, secure service to their clients. By embracing this technology, TPAs can stay ahead of the curve, ensuring their operations remain resilient and scalable in the face of future challenges.

Want to elevate your client onboarding and compliance workflows?

Schedule a demo with one of our CXperts today and revolutionize your operations.